Steps To Successfully Finance Your New Car Loan With Islamic Rules

페이지 정보

본문

Contact us at present and let our skilled group allow you to obtain your financial targets whereas respecting your beliefs. Navigating the journey towards homeownership can appear daunting, especially when your faith dictates specific monetary guidelines. A Halal Mortgage is a novel possibility in the Islamic world that enables Muslims to enjoy the luxurious of home ownership whereas being true to their beliefs. Let’s uncover this progressive Islamic finance choice, its operations, and the way the Murabaha transaction flows into the equation. If you’re unsure on whether or not Islamic finance is the best selection for you and your loved ones, we encourage you to learn by way of our sources. Written by our group of specialists, you’ll get a walkthrough of the ideas of faith based finance and be equipped with all the necessities to develop your private finance data.

From the second you begin considering about your car purchase to the final payment, Jazeera is with you every step of the method in which. Our devoted group is here to help you, answer your questions, and provide the most effective financing options. Yes, we will refinance your current interest based loans to our Ijarah Thumma Albai and make your construction sharia compliant. This actual fact also reveals this is NOT a loan compensation as loan repayments do NOT include GST. Hence our settlement is a purely Rental Based financing settlement in the full sense and has no relationship to an interest-based loan facility.

Additionally, secondary documentation may be required, together with utility bills or financial institution statements, to corroborate the applicant’s residential address and further substantiate their identification. This layered method to verification is critical to sustaining the integrity and trust inherent in sharia compliant monetary transactions. Once you have chosen a supplier, the following step is applying in your Murabahah car finance. The course of usually includes expressing your intent to purchase a car utilizing Murabahah financing, agreeing on the phrases, buying and promoting of the car by the provider, and finally, repaying the loan over the agreed period.

Halal car finance differs from typical finance because Islam strictly prohibits curiosity (riba), viewing it as a follow that may widen the gap between wealthy and poor. Islamic finance operates with out curiosity, based mostly on the belief that money itself shouldn’t generate more cash. Instead, worth comes from honest, transparent transactions that benefit each parties.

Meezan Invest will then use the sharia compliant investment universe to construct the portfolio which is made up of predominantly mid to large cap growth and different investments. Where potential, Lifespan will seek diversification of stocks and sectors. Our strategy seeks to maximise threat adjusted returns for the portfolio such that the portfolio outperforms within the medium and long run. Lifespan will assess the financial cycle through the use of a variety of macro and micro financial indicators however remains fashion impartial. We may even use each qualitative and quantitative inputs to understand the drivers and dangers of market sentiment, especially in periods where valuations are at excessive ranges. Finally, contemplating all the above we'll choose the stocks to include within the portfolios.

Mcca Islamic House Finance Australia Shariah Compliant Halal Finance Muslim Mortgage

Childcare not being obtainable and childcare prices were other reasons. "The dangers local weather change poses for coffee have been evident for some time," he says. "This could give consumers around the world few options to keep away from greater orange juice prices."

Ijarah Finance operates underneath the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the choice to own the leased asset at the finish of the lease period. If you've a singular car or asset scenario that you simply would like to talk about with us, simply request a name again from our staff. Whether it's your subsequent residence or an funding property, we'll information you thru the process. She says early childcare funded by the private sector and government pre-school funding is insufficient.

We congratulate you for making the best choice and deciding on the halal house loan various. Once you might have completed and submitted this form, a devoted MCCA gross sales executive will contact you inside 1 enterprise day to stroll you through the next stage of your utility. MCCA’s finance merchandise have been the go-to choice for Australia’s Muslim group, allowing thousands of goals to return true. If the property does receive a decrease than expected valuation, you might be required to offer a larger deposit in your application to obtain success. The MCCA workers member processing your software will communicate the options opened to you almost about progressing the application. The funder’s insurer or funder can at any time of the application process ask for any data that they deem is required to evolve to their set pointers.

Acknowledgement of CountryWe acknowledge the Aboriginal and Torres Strait Islander peoples as the primary Australians and Traditional Custodians of the lands where we stay, work and bank. If you wish to improve your financed amount, then you will need to amend your application to be reassessed once more. Yes, accredited applicants might want to nominate an Australian checking account held of their name(s) from which the agreed finance instalments will be debited. ICFAL offered some adjustments to how Ijaarah finance contracts work in Australia. ICFAL proposed to make the Ijaarah house finance mannequin extra like rental legal guidelines than credit score laws. Invest your hard-earned cash the halal approach to personal the home and name it residence.

Initially, people should assess their monetary capabilities to determine an reasonably priced worth range for the vehicle. Subsequently, researching reputable Islamic finance brokers is important to find a provider that offers aggressive profit rates and follows Sharia-compliant practices. Once an acceptable broker is recognized, the next step includes gathering the required fundamental documents, corresponding to proof of income and identification, to support the applying for submission.

Islamic Banking And Finance Business Banking

Islamic Banking And Finance Business Banking

Sharia – compliant loans take roughly the identical time to arrange as western-style mortgages. That can involve valuations and an in depth examination of your private monetary circumstances so it’s a good suggestion to allow a couple of weeks. Depending on how easy your state of affairs is, it might be slightly quicker or take slightly longer. As you'll be able to see, Islamic residence loans differ from conventional Australian mortgages in more than mere terminology. They’re invaluable and essential for Muslim homebuyers because they had been designed from the ground as a lot as provide an alternative alternative to mortgages that respect Sharia law and the Islamic perception system. Musharakah Mutanaqisah works virtually precisely alongside the identical strains as a western mortgage, in that each types of homebuyers gain fairness as they repay.

Asset-backed financing serves as an essential instrument in Islamic finance, enabling people and businesses to entry the required funds with out resorting to interest-based transactions. This form of financing promotes financial inclusion and financial growth inside the framework of Islamic finance principles. You don’t should pay interest utilizing the same old PCP or HP, this fashion.

With a median rating of 5 stars throughout Google, Facebook, and Trustpilot, it’s no surprise why our clients belief us for his or her Islamic banking wants. If you've a unique car or asset situation that you just want to talk about with us, merely request a call back from our team. You might be invited to ICFAL to discuss potential month-to-month cost and contract process. Whether it is your next residence or an investment property, we'll information you through the method. The company watchdog obtained the Federal Court order in opposition to Usman Siddiqui, the former head of Equitable Financial Solutions (EFSOL) which entered liquidation in 2019, to forestall him leaving the country.

Islamic asset-backed financing serves as a versatile device in Islamic finance, facilitating varied Halal financial activities similar to mortgages, car financing, and enterprise asset funding. Through constructions like Asset-Backed Sharia Mortgages or Loans, Islamic banks can present moral financing options to shoppers whereas adhering to Sharia principles. This type of financing allows the Islamic financial sector to assist economic development and growth in compliance with Islamic law. To sum up, asset-backed financing in Islamic finance is a technique of funding that involves utilizing tangible belongings to secure funding in compliance with Islamic rules. This kind of financing can be utilized for varied purposes such as actual estate improvement, infrastructure projects, and tools purchases. Asset-backed financing provides a Sharia-compliant various to standard interest-based financing, providing moral investment alternatives for individuals and businesses inside the Islamic finance industry.

Our easy asset finance loans will get you behind the wheel quick. Once we’ve verified your data, we’ll give you the loan documentation setting out your interest rate and other important data. Keep in thoughts that the speed proven in the loan documentation is topic to alter and could also be different on the day of settlement. Choose from one to seven years, with weekly, fortnightly or month-to-month repayment options.

Mcca Islamic Home Finance Australia Shariah Compliant Halal Finance Muslim Mortgage

When individuals and institutions have interaction in trustworthy monetary transactions, the... Ethical financing solutions have turn into more and more essential for empowering small businesses and providing them with the necessary assets to thrive. In distinction to conventional lending choices, which might often be restrictive and unique, ethica... Financing opportunities for international infrastructure initiatives present a vital foundation for financial development and development. As international locations try to build and maintain their bodily infrastructure, there's a urgent want for adequate financial reso... Unconventional funding approaches have turn into increasingly essential in empowering sustainable agriculture initiatives.

Islamic finance providers like Halal Loans cater to the particular wants of Australian residents who seek Sharia-compliant finance providers. Finance contracts for Islamic car loans usually include versatile terms that enable borrowers to customise their monthly installments primarily based on their budget and financial capabilities. Conditional approval may be granted once the preliminary assessment is accomplished, after which further verification may be required. The utility course of for Islamic car finance goals to supply an accessible and Sharia-compliant financing possibility for people seeking to buy a car while upholding their moral beliefs. Applicants should provide sturdy proof of identification to comply with the stringent verification processes required for Islamic car financing. A basic aspect of making certain that halal car finance aligns with sharia compliant principles includes thorough scrutiny of the applicant’s private identification.

Islamic car financing in Australia is part of the broader Islamic finance sector, which aims to provide compliant Islamic Financing solutions and other monetary products. This niche market continues to increase, allowing Muslims to entry services that align with their spiritual beliefs. By opting for Islamic car loans in Australia, individuals can fulfill their automobile ownership needs without compromising their faith. As the demand for Sharia-compliant financing grows, more establishments are more doubtless to offer tailored Islamic finance options, contributing to the accessibility and availability of halal financial options. When delving into the aspects of Halal financing, one encounters the unique options of a Halal Mortgage. This route to homeownership adheres to Sharia ideas, permitting Muslim house patrons to buy property without participating in interest-based transactions.

If you’d ideally like a house loan but are nervous about it contravening Sharia legislation, take heart. There are types of Islamic home loans that imply your dream can now come true. We had had been refused and knocked again by our huge four lender several occasions and even mortgage brokers were reluctant to assist us.

Look no further, because the halal financing answer you have been waiting for is right here. Islamic finance has been revolutionizing borrowing by offering a Shariah-compl... Islamic financing offers a Sharia-compliant alternative for people who wish to own a house with out participating in interest-based transactions. It is based on the principles of fairness, transparency, and cooperation. Halal loans and standard loans are two distinct financing options that cater to totally different financial wants and adhere to completely different principles. One of the key distinctions between the 2 is the underlying concept of interest.

Islamic Investment Finance Riyadh Islamic Finance

Understanding the principles behind this unique form of financing is important for both monetary establishments and indiv... Halal loans, rooted in the ideas of Islamic finance, have gained important reputation in recent times. These loans adhere to the moral and ethical requirements set by Shariah regulation, making them a gorgeous possibility for individuals and businesses se... Islamic banking is a financial system that operates based on the ideas of Shariah legislation. In Islamic banking, the idea of profit sharing and risk sharing is emphasized, and all transactions have to be free from parts of usury (riba) and unce...

This form of Islamic finance is where the funder will purchase an asset on behalf of a consumer, then promote it to the shopper on the buy price plus an agreed profit margin (mark-up). The revenue that the funder places on high of the asset’s purchase value is for the providers and prices incurred by the funder to secure and purchase the asset. The client will make common funds to the funder till the purchase value plus profit margin has been repaid.

Limit shall be taxed at your marginal tax fee, plus an excess concessional contributions charge. From 1 July 2019 you might be able to carry forward any unused portion of the concessional contributions cap from previous monetary years. Here is more information regarding Sharia-compliant loan alternatives check out our own internet site. Eligibility standards applies, see the Super contributions restrict truth sheet for full particulars. This implies that advantages like vacation loading and additional time might be affected if they’re tied to your wage. To shield your benefits while salary sacrificing, you’ll need to reach an settlement with your employer.

Equitable collateral practices play an important position in guaranteeing fair and simply transactions in the realm of Halal financing. Collateral, which serves as a safety for the lender in case of default, holds significant significance in figuring out the terms... Understanding the elements that impact your loan eligibility is crucial to make sure a clean and profitable loan utility process. Our loans are designed to let you access the fairness you have constructed up in your property (that is the difference between what your house is worth, and what you owe).

Halal financing has gained significant traction in current years, significantly within the context of infrastructure growth. This surge in demand may be attributed to several factors, including the rising Muslim inhabitants and their growing emphas... Choosing a shorter loan tenure might seem like a good idea at first, as it means you may be debt-free sooner.

Eventually, the asset is wholly paid off by the shopper they usually own the house outright. The Islamic method to ethical financing is rooted within the ideas of Sharia legislation, which is derived from the teachings of the Quran and the Hadith (sayings and actions of Prophet Muhammad, peace be upon him). Empowering Financial Decisions for the Muslim CommunityIn today's fast-paced world, monetary selections play a vital function in shaping our lives.

A listed company’s business and monetary place might change over time and such adjustments may affect both the shariah compliance of the company and relative "purification" proportion. Where potential, Lifespan will seek diversification of stocks and sectors. Our method seeks to maximise risk adjusted returns for the portfolio such that the portfolio outperforms in the medium and long term. Lifespan will assess the economic cycle by using a range of macro and micro economic indicators but remains style neutral. We will also use both qualitative and quantitative inputs to know the drivers and dangers of market sentiment, especially in durations where valuations are at excessive ranges. Finally, considering all the above we will select the stocks to include in the portfolios.

Islamic Car Financing: How Does It Really Work?

The customer will seek the specified car or equipment, but the funder will purchase the asset on behalf of the shopper and hold legal title until ultimate cost or buyout has been completed by the client. The tax bill on buy will be made out to the financier, but the tools will be delivered to the shopper for their full use. You shall be invited to ICFAL to discuss potential month-to-month fee and contract course of. Apply on-line to prequalify and see if you’re eligible for car finance with ICFAL. As we gaze into the crystal ball, the future of Halal car financing seems both promising and exciting. The industry has been witnessing several constructive trends and developments that bode nicely for its future development.

The customer will seek the specified car or equipment, but the funder will purchase the asset on behalf of the shopper and hold legal title until ultimate cost or buyout has been completed by the client. The tax bill on buy will be made out to the financier, but the tools will be delivered to the shopper for their full use. You shall be invited to ICFAL to discuss potential month-to-month fee and contract course of. Apply on-line to prequalify and see if you’re eligible for car finance with ICFAL. As we gaze into the crystal ball, the future of Halal car financing seems both promising and exciting. The industry has been witnessing several constructive trends and developments that bode nicely for its future development.

Islamic automobile finance, rooted within the ideas of Sharia legislation, presents a structured strategy to car financing that guarantees moral and interest-free transactions. This type of finance supplies Muslims the chance to accumulate the car of their desires without participating in interest-based agreements, which are prohibited in Islam. In ijarah finance, the monetary institution purchases the car and leases it to the customer. The terms of the lease are clearly defined in finance contracts, together with the lease interval and the revenue margin for the monetary institution. Upon completion of the lease period, ownership of the vehicle is transferred to the shopper, ensuring a Shariah-compliant transaction.

Yes, we can refinance your present interest based mostly loans to our Ijarah Thumma Albai and make your structure sharia compliant. This very fact additionally shows that is NOT a loan reimbursement as loan repayments do NOT embody GST. Hence our settlement is a purely Rental Based financing settlement within the full sense and has no relationship to an interest-based loan facility. Our financing agreement doesn't fluctuate with RBA modifications throughout the term making certain compliance to the strictest rules of sharia.

Furthermore, opting for car finance halal allows consumers to maintain their spiritual and ethical integrity while fulfilling their need for private transportation. Murabahah car financing, on the other hand, includes the Islamic bank buying the car after which promoting it to the client at a revenue. This profit margin is pre-agreed and transparent, guaranteeing that the transaction is ethical and free from interest (riba). Halal car finance, especially Murabahah, presents a fantastic alternative for those seeking ethical and secure financial solutions for car purchases in Australia. This information aims to focus on the clear advantages it provides, especially for these over the age of 30 who value monetary transparency and moral transactions.

While all care has been taken within the preparation to ensure the knowledge is correct, it could change from time to time. There isn't any illustration or warranty by Hejaz Financial Advisers that any of the knowledge is accurate or complete. When you apply for financing, your software is topic to credit approval by UIF Corporation using your full credit score history, related rating, earnings and other components to evaluate your request and talent to repay. You should authorize UIF Corporation to obtain a credit report and to validate the information on the applying.

Murabahah car financing, on the opposite hand, involves the Islamic bank buying the vehicle and then selling it to the customer at a revenue margin, which is agreed upon prematurely. This method guarantees transparency and avoids curiosity, making it a well-liked halal car financing choice. Additionally, customers ought to search suggestions from neighborhood members who've beforehand engaged with Islamic finance providers. Online critiques and ratings can even supply insights into the reliability and ethical standards of those institutions. This diligent strategy fosters belief and confidence in securing a halal financial solution.

These usually cost an interest rate – a percentage charged on the total quantity you borrow or save, which is typically paid for monthly. It avoids the idea of interest and as a substitute depends on several permissible buildings such as Murabaha, Ijarah, and Musharakah. These constructions are designed to adjust to Islamic law whereas providing practical financial solutions.

Residence Of Amanah Islamic Finance

This agreement does NOT CHARGE ANY INTEREST and is strictly primarily based on rental-to-buy ideas. The Agreement is a Rental Agreement and NOT a loan agreement primarily based on curiosity. Car finance with ICFAL lets you purchase model new or a used for your day by day usage. These options are complimented with competitive options that permit you to get a car by Halal means. Well, underneath an Islamic contract, the financial institution can not cost compound curiosity if a customer defaults or misses a cost.

This construction ensures compliance with Sharia regulation, as it avoids interest-based transactions. Alternatively, in cost-plus financing, the financial establishment buys the automobile and sells it to the customer at a better worth, which includes a predetermined profit margin. The purchaser can then repay this quantity in installments, making it a sharia-compliant financing option. A typical finance settlement involving vehicles or tools is known as a Chattel Mortgage or Equipment Loan. This is strictly an interest-based loan settlement where money is lent and borrowed on curiosity between the lender and the borrower.

We are continuously looking at ways to make our lives over right here compliant with our Islamic teachings and are presently researching a unbelievable new opportunity. As I mentioned above with the assistance of Andrew we've give you an easy information to buying the car you need on a zero p.c association. There are no hidden fees or expenses that can shock you down the line just the car, a monthly payment and no curiosity expenses. We have come up with Halal Car Finance – the perfect resolution which entails everything being tied up on the similar time at the same dealership with no curiosity being paid. Halal Car Finance or Islamic Car Finance has been the subject of many a conversation all through our community whether that be students, imaams or only a family dialogue.

This transaction is clear and devoid of interest, adhering to the ethical tips of Islamic finance. Another approach is Ijarah, akin to leasing, the place the financial institution retains possession of the car and the customer pays rental fees until they finally purchase the vehicle. Upon submission of the required documentation, candidates for Islamic Car Finance bear a thorough analysis process to determine eligibility for Sharia-compliant automobile financing.

This method allows you to access the assets you need with out getting into into interest-based contracts, ensuring your financial activities align together with your faith. We do that by way of our Ijarah Thuma Albai financing construction which is rental based mostly. It's interest-free, has clear pricing, provides flexible phrases, and grants instant possession. It's a halal different to conventional loans, making it a gorgeous choice for so much of individuals and companies.

This actual fact also exhibits that is NOT a loan repayment as loan repayments do NOT embrace GST. Hence our agreement is a purely Rental Based financing settlement in the full sense and has no relationship to an interest-based loan facility. Ijarah Finance operates under the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the option to personal the leased asset on the end of the lease interval. Buying the car in installment utilizing a halal contract allows you to own a car comfortable. Putting Shariah compliance first with none compromise on islamic principles. An Islamic or takaful insurance has the role of covering a car against all of the dangers.

From the second you begin considering about your car purchase to the final payment, Jazeera is with you every step of the method in which. Our devoted group is here to help you, answer your questions, and provide the most effective financing options. Yes, we will refinance your current interest based loans to our Ijarah Thumma Albai and make your construction sharia compliant. This actual fact also reveals this is NOT a loan compensation as loan repayments do NOT include GST. Hence our settlement is a purely Rental Based financing settlement in the full sense and has no relationship to an interest-based loan facility.

Additionally, secondary documentation may be required, together with utility bills or financial institution statements, to corroborate the applicant’s residential address and further substantiate their identification. This layered method to verification is critical to sustaining the integrity and trust inherent in sharia compliant monetary transactions. Once you have chosen a supplier, the following step is applying in your Murabahah car finance. The course of usually includes expressing your intent to purchase a car utilizing Murabahah financing, agreeing on the phrases, buying and promoting of the car by the provider, and finally, repaying the loan over the agreed period.

Halal car finance differs from typical finance because Islam strictly prohibits curiosity (riba), viewing it as a follow that may widen the gap between wealthy and poor. Islamic finance operates with out curiosity, based mostly on the belief that money itself shouldn’t generate more cash. Instead, worth comes from honest, transparent transactions that benefit each parties.

Meezan Invest will then use the sharia compliant investment universe to construct the portfolio which is made up of predominantly mid to large cap growth and different investments. Where potential, Lifespan will seek diversification of stocks and sectors. Our strategy seeks to maximise threat adjusted returns for the portfolio such that the portfolio outperforms within the medium and long run. Lifespan will assess the financial cycle through the use of a variety of macro and micro financial indicators however remains fashion impartial. We may even use each qualitative and quantitative inputs to understand the drivers and dangers of market sentiment, especially in periods where valuations are at excessive ranges. Finally, contemplating all the above we'll choose the stocks to include within the portfolios.

Mcca Islamic House Finance Australia Shariah Compliant Halal Finance Muslim Mortgage

Childcare not being obtainable and childcare prices were other reasons. "The dangers local weather change poses for coffee have been evident for some time," he says. "This could give consumers around the world few options to keep away from greater orange juice prices."

Ijarah Finance operates underneath the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the choice to own the leased asset at the finish of the lease period. If you've a singular car or asset scenario that you simply would like to talk about with us, simply request a name again from our staff. Whether it's your subsequent residence or an funding property, we'll information you thru the process. She says early childcare funded by the private sector and government pre-school funding is insufficient.

We congratulate you for making the best choice and deciding on the halal house loan various. Once you might have completed and submitted this form, a devoted MCCA gross sales executive will contact you inside 1 enterprise day to stroll you through the next stage of your utility. MCCA’s finance merchandise have been the go-to choice for Australia’s Muslim group, allowing thousands of goals to return true. If the property does receive a decrease than expected valuation, you might be required to offer a larger deposit in your application to obtain success. The MCCA workers member processing your software will communicate the options opened to you almost about progressing the application. The funder’s insurer or funder can at any time of the application process ask for any data that they deem is required to evolve to their set pointers.

Acknowledgement of CountryWe acknowledge the Aboriginal and Torres Strait Islander peoples as the primary Australians and Traditional Custodians of the lands where we stay, work and bank. If you wish to improve your financed amount, then you will need to amend your application to be reassessed once more. Yes, accredited applicants might want to nominate an Australian checking account held of their name(s) from which the agreed finance instalments will be debited. ICFAL offered some adjustments to how Ijaarah finance contracts work in Australia. ICFAL proposed to make the Ijaarah house finance mannequin extra like rental legal guidelines than credit score laws. Invest your hard-earned cash the halal approach to personal the home and name it residence.

Initially, people should assess their monetary capabilities to determine an reasonably priced worth range for the vehicle. Subsequently, researching reputable Islamic finance brokers is important to find a provider that offers aggressive profit rates and follows Sharia-compliant practices. Once an acceptable broker is recognized, the next step includes gathering the required fundamental documents, corresponding to proof of income and identification, to support the applying for submission.

Islamic Banking And Finance Business Banking

Islamic Banking And Finance Business BankingSharia – compliant loans take roughly the identical time to arrange as western-style mortgages. That can involve valuations and an in depth examination of your private monetary circumstances so it’s a good suggestion to allow a couple of weeks. Depending on how easy your state of affairs is, it might be slightly quicker or take slightly longer. As you'll be able to see, Islamic residence loans differ from conventional Australian mortgages in more than mere terminology. They’re invaluable and essential for Muslim homebuyers because they had been designed from the ground as a lot as provide an alternative alternative to mortgages that respect Sharia law and the Islamic perception system. Musharakah Mutanaqisah works virtually precisely alongside the identical strains as a western mortgage, in that each types of homebuyers gain fairness as they repay.

Asset-backed financing serves as an essential instrument in Islamic finance, enabling people and businesses to entry the required funds with out resorting to interest-based transactions. This form of financing promotes financial inclusion and financial growth inside the framework of Islamic finance principles. You don’t should pay interest utilizing the same old PCP or HP, this fashion.

With a median rating of 5 stars throughout Google, Facebook, and Trustpilot, it’s no surprise why our clients belief us for his or her Islamic banking wants. If you've a unique car or asset situation that you just want to talk about with us, merely request a call back from our team. You might be invited to ICFAL to discuss potential month-to-month cost and contract process. Whether it is your next residence or an investment property, we'll information you through the method. The company watchdog obtained the Federal Court order in opposition to Usman Siddiqui, the former head of Equitable Financial Solutions (EFSOL) which entered liquidation in 2019, to forestall him leaving the country.

Islamic asset-backed financing serves as a versatile device in Islamic finance, facilitating varied Halal financial activities similar to mortgages, car financing, and enterprise asset funding. Through constructions like Asset-Backed Sharia Mortgages or Loans, Islamic banks can present moral financing options to shoppers whereas adhering to Sharia principles. This type of financing allows the Islamic financial sector to assist economic development and growth in compliance with Islamic law. To sum up, asset-backed financing in Islamic finance is a technique of funding that involves utilizing tangible belongings to secure funding in compliance with Islamic rules. This kind of financing can be utilized for varied purposes such as actual estate improvement, infrastructure projects, and tools purchases. Asset-backed financing provides a Sharia-compliant various to standard interest-based financing, providing moral investment alternatives for individuals and businesses inside the Islamic finance industry.

Our easy asset finance loans will get you behind the wheel quick. Once we’ve verified your data, we’ll give you the loan documentation setting out your interest rate and other important data. Keep in thoughts that the speed proven in the loan documentation is topic to alter and could also be different on the day of settlement. Choose from one to seven years, with weekly, fortnightly or month-to-month repayment options.

Mcca Islamic Home Finance Australia Shariah Compliant Halal Finance Muslim Mortgage

When individuals and institutions have interaction in trustworthy monetary transactions, the... Ethical financing solutions have turn into more and more essential for empowering small businesses and providing them with the necessary assets to thrive. In distinction to conventional lending choices, which might often be restrictive and unique, ethica... Financing opportunities for international infrastructure initiatives present a vital foundation for financial development and development. As international locations try to build and maintain their bodily infrastructure, there's a urgent want for adequate financial reso... Unconventional funding approaches have turn into increasingly essential in empowering sustainable agriculture initiatives.

Islamic finance providers like Halal Loans cater to the particular wants of Australian residents who seek Sharia-compliant finance providers. Finance contracts for Islamic car loans usually include versatile terms that enable borrowers to customise their monthly installments primarily based on their budget and financial capabilities. Conditional approval may be granted once the preliminary assessment is accomplished, after which further verification may be required. The utility course of for Islamic car finance goals to supply an accessible and Sharia-compliant financing possibility for people seeking to buy a car while upholding their moral beliefs. Applicants should provide sturdy proof of identification to comply with the stringent verification processes required for Islamic car financing. A basic aspect of making certain that halal car finance aligns with sharia compliant principles includes thorough scrutiny of the applicant’s private identification.

Islamic car financing in Australia is part of the broader Islamic finance sector, which aims to provide compliant Islamic Financing solutions and other monetary products. This niche market continues to increase, allowing Muslims to entry services that align with their spiritual beliefs. By opting for Islamic car loans in Australia, individuals can fulfill their automobile ownership needs without compromising their faith. As the demand for Sharia-compliant financing grows, more establishments are more doubtless to offer tailored Islamic finance options, contributing to the accessibility and availability of halal financial options. When delving into the aspects of Halal financing, one encounters the unique options of a Halal Mortgage. This route to homeownership adheres to Sharia ideas, permitting Muslim house patrons to buy property without participating in interest-based transactions.

If you’d ideally like a house loan but are nervous about it contravening Sharia legislation, take heart. There are types of Islamic home loans that imply your dream can now come true. We had had been refused and knocked again by our huge four lender several occasions and even mortgage brokers were reluctant to assist us.

Look no further, because the halal financing answer you have been waiting for is right here. Islamic finance has been revolutionizing borrowing by offering a Shariah-compl... Islamic financing offers a Sharia-compliant alternative for people who wish to own a house with out participating in interest-based transactions. It is based on the principles of fairness, transparency, and cooperation. Halal loans and standard loans are two distinct financing options that cater to totally different financial wants and adhere to completely different principles. One of the key distinctions between the 2 is the underlying concept of interest.

Islamic Investment Finance Riyadh Islamic Finance

Understanding the principles behind this unique form of financing is important for both monetary establishments and indiv... Halal loans, rooted in the ideas of Islamic finance, have gained important reputation in recent times. These loans adhere to the moral and ethical requirements set by Shariah regulation, making them a gorgeous possibility for individuals and businesses se... Islamic banking is a financial system that operates based on the ideas of Shariah legislation. In Islamic banking, the idea of profit sharing and risk sharing is emphasized, and all transactions have to be free from parts of usury (riba) and unce...

This form of Islamic finance is where the funder will purchase an asset on behalf of a consumer, then promote it to the shopper on the buy price plus an agreed profit margin (mark-up). The revenue that the funder places on high of the asset’s purchase value is for the providers and prices incurred by the funder to secure and purchase the asset. The client will make common funds to the funder till the purchase value plus profit margin has been repaid.

Limit shall be taxed at your marginal tax fee, plus an excess concessional contributions charge. From 1 July 2019 you might be able to carry forward any unused portion of the concessional contributions cap from previous monetary years. Here is more information regarding Sharia-compliant loan alternatives check out our own internet site. Eligibility standards applies, see the Super contributions restrict truth sheet for full particulars. This implies that advantages like vacation loading and additional time might be affected if they’re tied to your wage. To shield your benefits while salary sacrificing, you’ll need to reach an settlement with your employer.

Equitable collateral practices play an important position in guaranteeing fair and simply transactions in the realm of Halal financing. Collateral, which serves as a safety for the lender in case of default, holds significant significance in figuring out the terms... Understanding the elements that impact your loan eligibility is crucial to make sure a clean and profitable loan utility process. Our loans are designed to let you access the fairness you have constructed up in your property (that is the difference between what your house is worth, and what you owe).

Halal financing has gained significant traction in current years, significantly within the context of infrastructure growth. This surge in demand may be attributed to several factors, including the rising Muslim inhabitants and their growing emphas... Choosing a shorter loan tenure might seem like a good idea at first, as it means you may be debt-free sooner.

Eventually, the asset is wholly paid off by the shopper they usually own the house outright. The Islamic method to ethical financing is rooted within the ideas of Sharia legislation, which is derived from the teachings of the Quran and the Hadith (sayings and actions of Prophet Muhammad, peace be upon him). Empowering Financial Decisions for the Muslim CommunityIn today's fast-paced world, monetary selections play a vital function in shaping our lives.

A listed company’s business and monetary place might change over time and such adjustments may affect both the shariah compliance of the company and relative "purification" proportion. Where potential, Lifespan will seek diversification of stocks and sectors. Our method seeks to maximise risk adjusted returns for the portfolio such that the portfolio outperforms in the medium and long term. Lifespan will assess the economic cycle by using a range of macro and micro economic indicators but remains style neutral. We will also use both qualitative and quantitative inputs to know the drivers and dangers of market sentiment, especially in durations where valuations are at excessive ranges. Finally, considering all the above we will select the stocks to include in the portfolios.

Islamic Car Financing: How Does It Really Work?

The customer will seek the specified car or equipment, but the funder will purchase the asset on behalf of the shopper and hold legal title until ultimate cost or buyout has been completed by the client. The tax bill on buy will be made out to the financier, but the tools will be delivered to the shopper for their full use. You shall be invited to ICFAL to discuss potential month-to-month fee and contract course of. Apply on-line to prequalify and see if you’re eligible for car finance with ICFAL. As we gaze into the crystal ball, the future of Halal car financing seems both promising and exciting. The industry has been witnessing several constructive trends and developments that bode nicely for its future development.

The customer will seek the specified car or equipment, but the funder will purchase the asset on behalf of the shopper and hold legal title until ultimate cost or buyout has been completed by the client. The tax bill on buy will be made out to the financier, but the tools will be delivered to the shopper for their full use. You shall be invited to ICFAL to discuss potential month-to-month fee and contract course of. Apply on-line to prequalify and see if you’re eligible for car finance with ICFAL. As we gaze into the crystal ball, the future of Halal car financing seems both promising and exciting. The industry has been witnessing several constructive trends and developments that bode nicely for its future development.Islamic automobile finance, rooted within the ideas of Sharia legislation, presents a structured strategy to car financing that guarantees moral and interest-free transactions. This type of finance supplies Muslims the chance to accumulate the car of their desires without participating in interest-based agreements, which are prohibited in Islam. In ijarah finance, the monetary institution purchases the car and leases it to the customer. The terms of the lease are clearly defined in finance contracts, together with the lease interval and the revenue margin for the monetary institution. Upon completion of the lease period, ownership of the vehicle is transferred to the shopper, ensuring a Shariah-compliant transaction.

Yes, we can refinance your present interest based mostly loans to our Ijarah Thumma Albai and make your structure sharia compliant. This very fact additionally shows that is NOT a loan reimbursement as loan repayments do NOT embody GST. Hence our settlement is a purely Rental Based financing settlement within the full sense and has no relationship to an interest-based loan facility. Our financing agreement doesn't fluctuate with RBA modifications throughout the term making certain compliance to the strictest rules of sharia.

Furthermore, opting for car finance halal allows consumers to maintain their spiritual and ethical integrity while fulfilling their need for private transportation. Murabahah car financing, on the other hand, includes the Islamic bank buying the car after which promoting it to the client at a revenue. This profit margin is pre-agreed and transparent, guaranteeing that the transaction is ethical and free from interest (riba). Halal car finance, especially Murabahah, presents a fantastic alternative for those seeking ethical and secure financial solutions for car purchases in Australia. This information aims to focus on the clear advantages it provides, especially for these over the age of 30 who value monetary transparency and moral transactions.

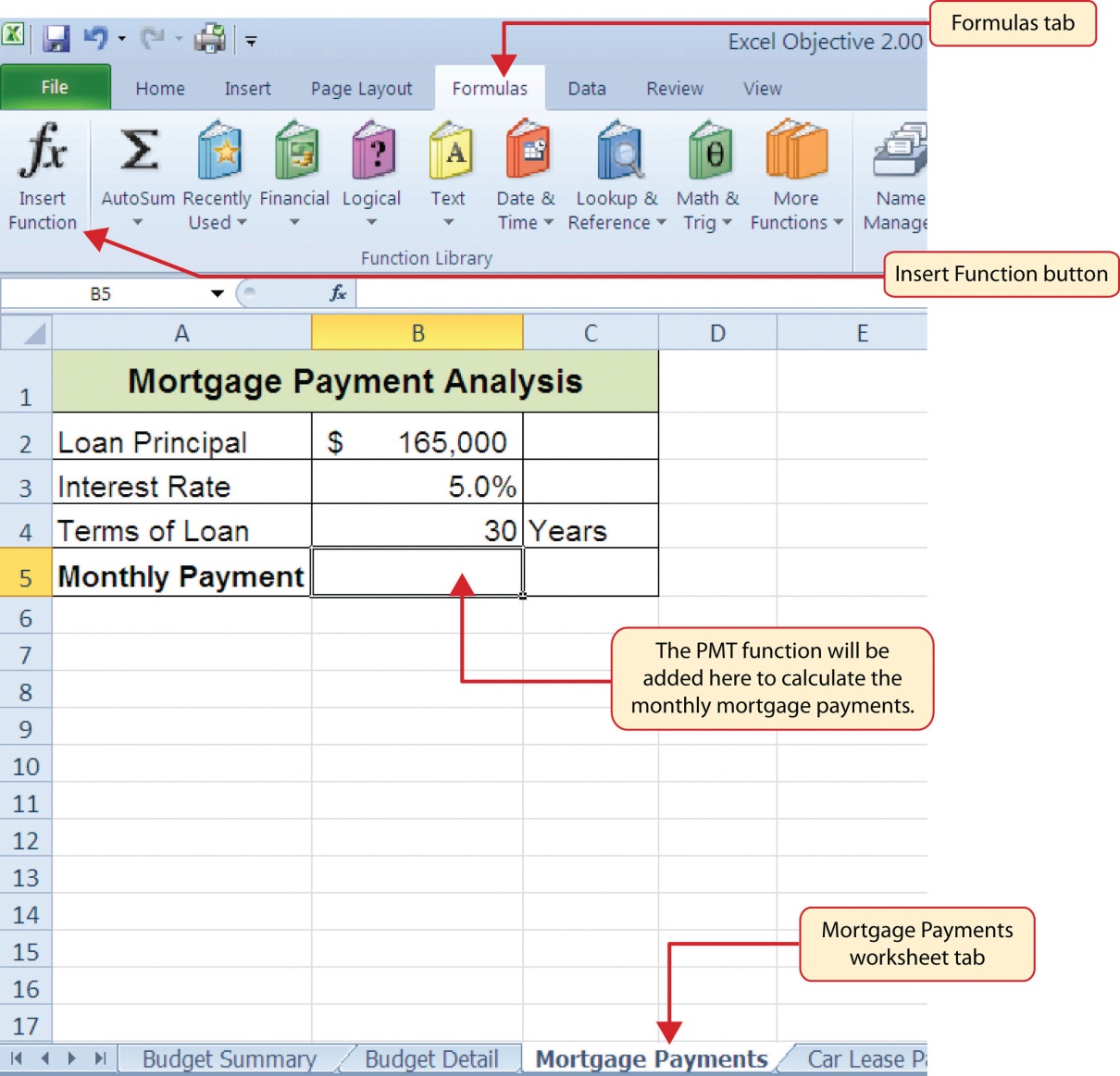

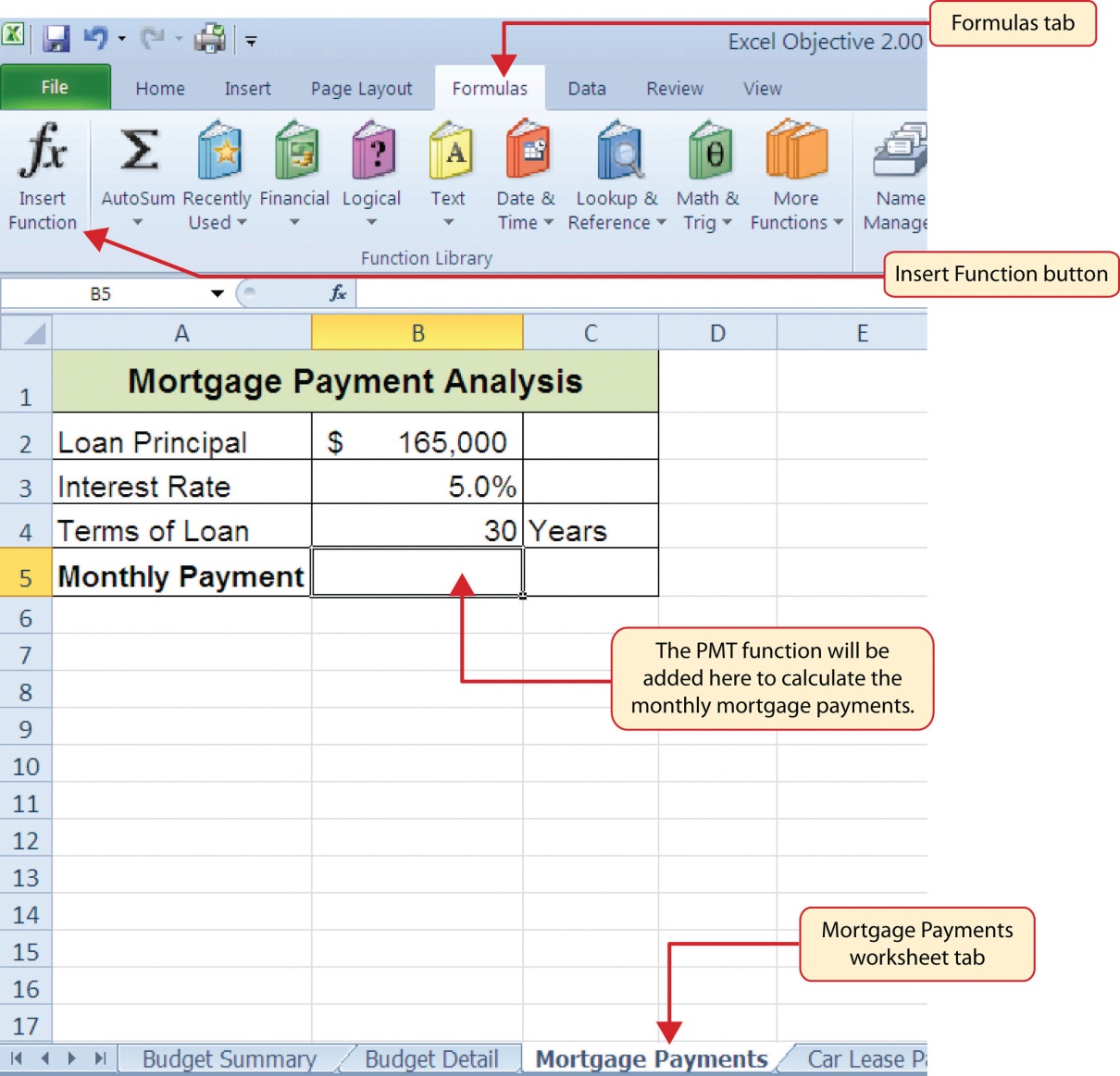

While all care has been taken within the preparation to ensure the knowledge is correct, it could change from time to time. There isn't any illustration or warranty by Hejaz Financial Advisers that any of the knowledge is accurate or complete. When you apply for financing, your software is topic to credit approval by UIF Corporation using your full credit score history, related rating, earnings and other components to evaluate your request and talent to repay. You should authorize UIF Corporation to obtain a credit report and to validate the information on the applying.

Murabahah car financing, on the opposite hand, involves the Islamic bank buying the vehicle and then selling it to the customer at a revenue margin, which is agreed upon prematurely. This method guarantees transparency and avoids curiosity, making it a well-liked halal car financing choice. Additionally, customers ought to search suggestions from neighborhood members who've beforehand engaged with Islamic finance providers. Online critiques and ratings can even supply insights into the reliability and ethical standards of those institutions. This diligent strategy fosters belief and confidence in securing a halal financial solution.

These usually cost an interest rate – a percentage charged on the total quantity you borrow or save, which is typically paid for monthly. It avoids the idea of interest and as a substitute depends on several permissible buildings such as Murabaha, Ijarah, and Musharakah. These constructions are designed to adjust to Islamic law whereas providing practical financial solutions.

Residence Of Amanah Islamic Finance

This agreement does NOT CHARGE ANY INTEREST and is strictly primarily based on rental-to-buy ideas. The Agreement is a Rental Agreement and NOT a loan agreement primarily based on curiosity. Car finance with ICFAL lets you purchase model new or a used for your day by day usage. These options are complimented with competitive options that permit you to get a car by Halal means. Well, underneath an Islamic contract, the financial institution can not cost compound curiosity if a customer defaults or misses a cost.

This construction ensures compliance with Sharia regulation, as it avoids interest-based transactions. Alternatively, in cost-plus financing, the financial establishment buys the automobile and sells it to the customer at a better worth, which includes a predetermined profit margin. The purchaser can then repay this quantity in installments, making it a sharia-compliant financing option. A typical finance settlement involving vehicles or tools is known as a Chattel Mortgage or Equipment Loan. This is strictly an interest-based loan settlement where money is lent and borrowed on curiosity between the lender and the borrower.

We are continuously looking at ways to make our lives over right here compliant with our Islamic teachings and are presently researching a unbelievable new opportunity. As I mentioned above with the assistance of Andrew we've give you an easy information to buying the car you need on a zero p.c association. There are no hidden fees or expenses that can shock you down the line just the car, a monthly payment and no curiosity expenses. We have come up with Halal Car Finance – the perfect resolution which entails everything being tied up on the similar time at the same dealership with no curiosity being paid. Halal Car Finance or Islamic Car Finance has been the subject of many a conversation all through our community whether that be students, imaams or only a family dialogue.

This transaction is clear and devoid of interest, adhering to the ethical tips of Islamic finance. Another approach is Ijarah, akin to leasing, the place the financial institution retains possession of the car and the customer pays rental fees until they finally purchase the vehicle. Upon submission of the required documentation, candidates for Islamic Car Finance bear a thorough analysis process to determine eligibility for Sharia-compliant automobile financing.

This method allows you to access the assets you need with out getting into into interest-based contracts, ensuring your financial activities align together with your faith. We do that by way of our Ijarah Thuma Albai financing construction which is rental based mostly. It's interest-free, has clear pricing, provides flexible phrases, and grants instant possession. It's a halal different to conventional loans, making it a gorgeous choice for so much of individuals and companies.

This actual fact also exhibits that is NOT a loan repayment as loan repayments do NOT embrace GST. Hence our agreement is a purely Rental Based financing settlement in the full sense and has no relationship to an interest-based loan facility. Ijarah Finance operates under the principle of Rent-To-Own otherwise known as Ijarah Muntahiya Bit Tamleek – A Lease Agreement with the option to personal the leased asset on the end of the lease interval. Buying the car in installment utilizing a halal contract allows you to own a car comfortable. Putting Shariah compliance first with none compromise on islamic principles. An Islamic or takaful insurance has the role of covering a car against all of the dangers.

- 이전글Backlink Energizer = Better Back Links 24.12.06

- 다음글9 Stunning Examples Of Beautiful Watch BeIN Sports 24.12.06

댓글목록

등록된 댓글이 없습니다.