Discretionary Trust Funds Vs System Depends On

페이지 정보

본문

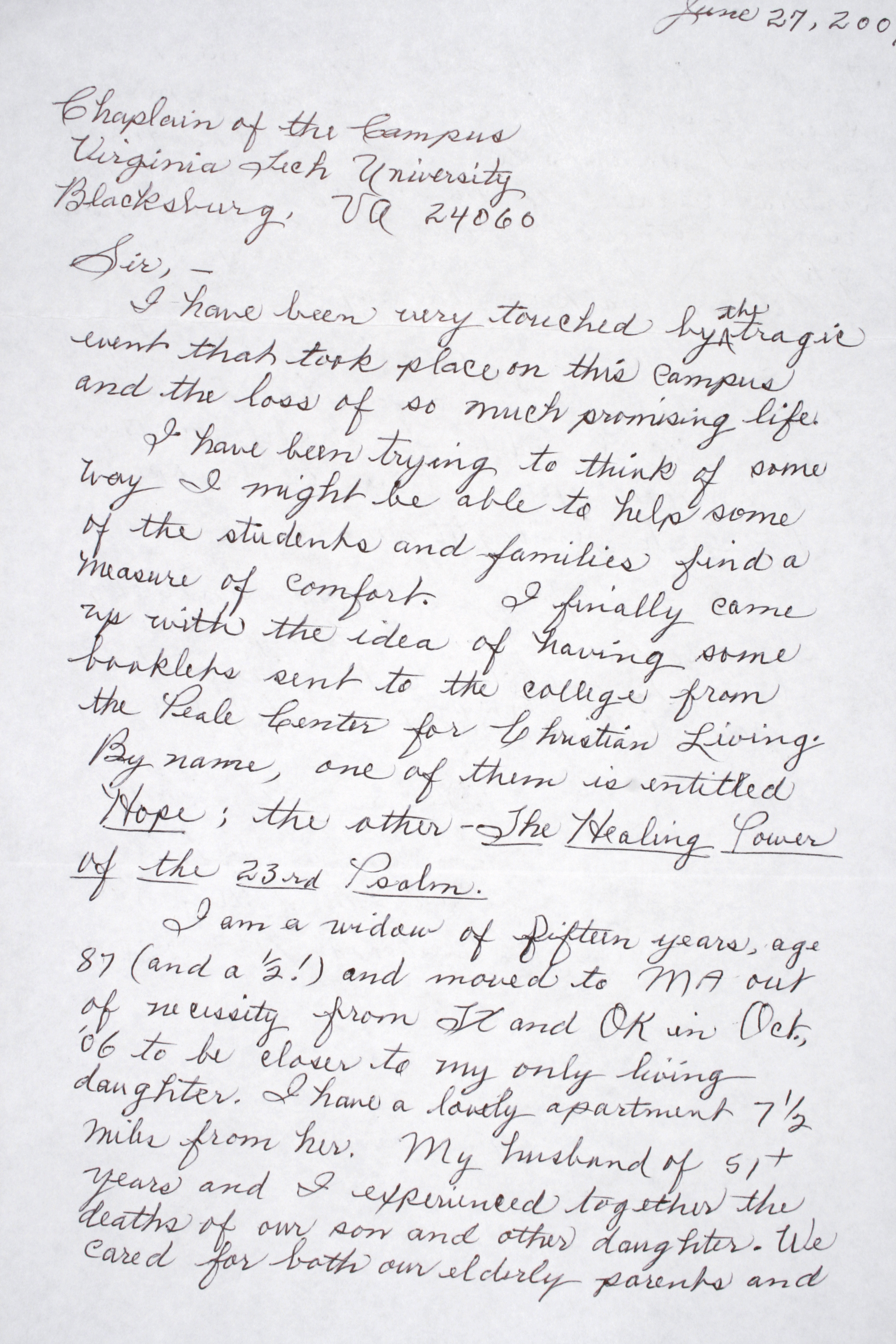

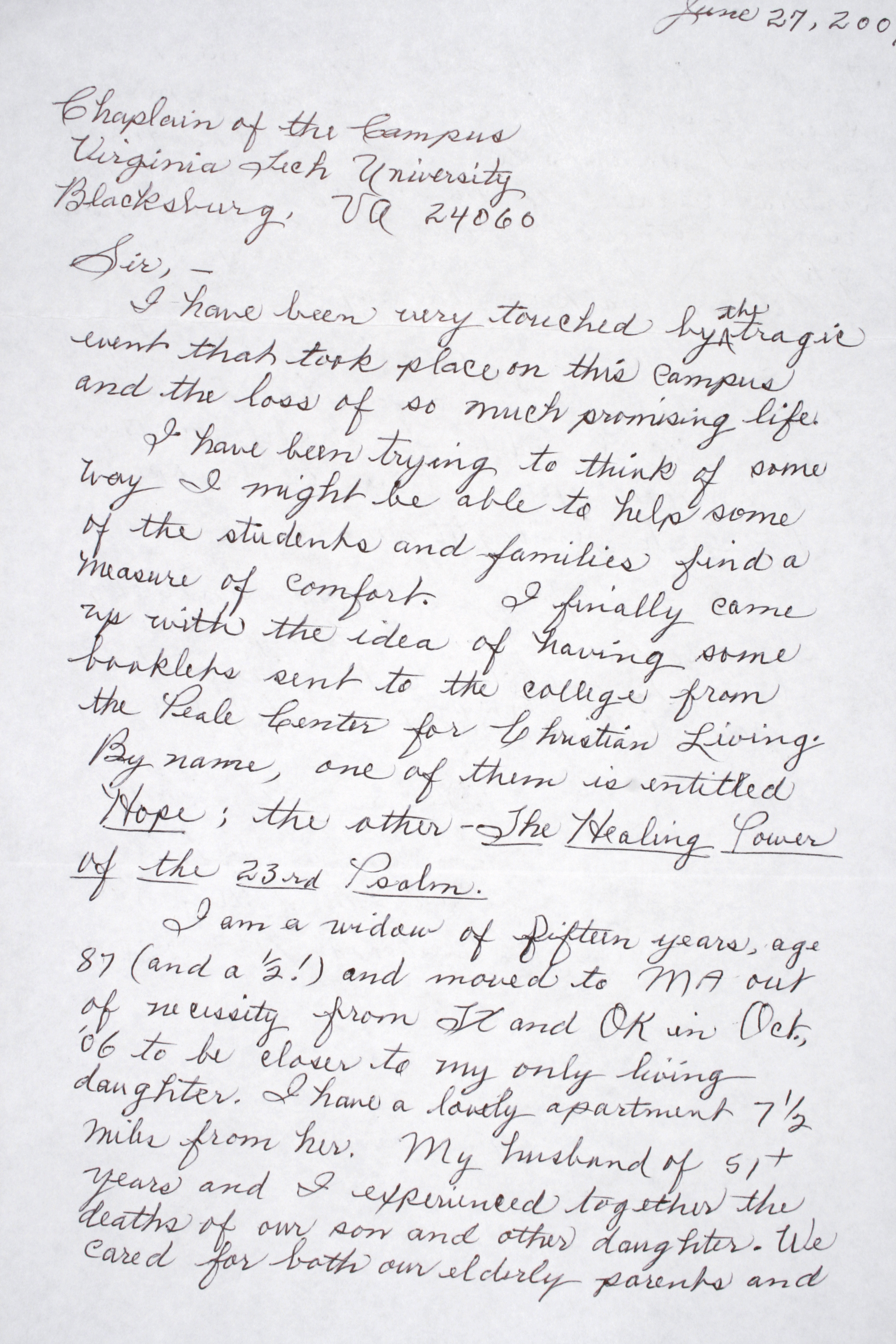

A Holographic Will is merely one more way to say a handwritten Will, and once more is only lawful in specific states. These Wills usually have various witness and trademark demands, so constantly contact your state's laws. Each Willful record produced comes with a thorough instruction web page to see to it all the Legal Documentation demands are followed so you can be certain that your last will and testimony will certainly be legally valid. A will is a legal paper that lays out just how you want your estate to be dispersed once you've passed away.

A created contract, i.e. a contract that is typed, published, or handwritten, is not necessarily much more legitimate than a spoken one that has actually just been mentioned orally. There are no lawful distinctions between keyed in and handwritten arrangements when it comes to enforceability. Ought to an event fail to execute before these dates, it leads to an awaiting breach.

Nevertheless, the RNRB can be recovered if the property is appointed out to guide offspring within 2 years of the testator's date of fatality-- section 144 of the Inheritance Act 1984. Do not hesitate to review your options initially with our team of solicitors and will certainly authors in Leicester. Just fill out the type, and we will promptly connect and assist with everything you require to get started. For additional details or recommendations about Discretionary Trusts or Estate Preparation in general, please contact us.

Benefits And Drawbacks Of Setting Up An Optional Trust Fund

A medical sturdy power of attorney paper differs from a living will, which information the medical therapies you desire at the end of your life. A power of attorney for healthcare enables your agent to make clinical choices whenever you are disabled, also if you're anticipated to make a complete recuperation. A depend on can be a useful estate planning device with possible benefits. However, trust funds can be complicated, and they may not be suitable for every person.

Ultimately, mention the day and authorize the will and ask 2 witnesses to authorize as well. Handwritten wills that are composed by the person making the will (called the testator), and have not been seen or notarized, are called holographic wills. Wills remained in existence long prior to computers and word processor, and long before typewriters.

Ultimately, mention the day and authorize the will and ask 2 witnesses to authorize as well. Handwritten wills that are composed by the person making the will (called the testator), and have not been seen or notarized, are called holographic wills. Wills remained in existence long prior to computers and word processor, and long before typewriters.

Who Can Create A Will In Canada?

A last will and testimony is a lawful file outlining your want just how your property and events are managed when you pass away and exactly how you desire your family to conduct your funeral service. Having a last will and testimony in place for when the moment comes makes this procedure much easier and cheaper. Your will certainly informs the court exactly what to do with your belongings, so there's much less for the court to kind through. Much less help the court implies your possessions will certainly be distributed quicker, and you'll pay much less in management and Probate Attorneys expenses. When someone passes away, their properties normally approach funeral service expenditures and probate court costs. Then, if the person has any type of outstanding debts, the administrator uses assets from the estate to resolve them.

Additional Estate Preparing Files

You could store the original file and a duplicate in a safe place, such as a fire resistant lockbox, a declaring cupboard, or a safe deposit box at a financial institution. It is necessary to make certain your administrator is aware of the location of your will certainly and has accessibility to it. If you require to make substantial changes, it's ideal technique to create a new Last Will and Asset Distribution Testament.

File Storage Space

Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove - The Washington Post Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove.

Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove - The Washington Post Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove.

Although not lawfully binding, Asset Distribution this offers trustees assistance on just how the settlor would such as the trust to be administered. The expression of desires might stipulate, for instance, that the recipients ought to obtain just income and not funding, or that possessions ought to be distributed on a beneficiary's 21st birthday celebration. When an optional depend on is produced, Asset Distribution the transfer of possessions right into the trust undergoes an immediate analysis to Estate tax ( IHT).

What Is An Optional Count On?

A reduced present trust fund is a trust fund which enables clients to distribute assets for IHT purposes, whilst still keeping a right to take normal withdrawals throughout their life time. The value of the present (the premium paid to the bond) is possibly discounted by the value of this maintained right (in basic terms, the right to obtain withdrawals is valued) to reduce the obligation to IHT instantly. Under the loan trust fund system a settlor assigns trustees for a discretionary count on and makes a lending to them on an interest-free basis, repayable as needed. The trustees after that typically spend the money right into a single costs bond (life guarantee or capital redemption version) for the trustees. The finance is repayable to the settlor on demand and can be paid on an ad hoc basis or as regular payments (withdrawals).

Optional beneficiaries have a basic legal right to have actually the Depend on provided in line with the regards to the trust fund record. The primary differences in between the kinds of depend on are the advantageous civil liberties that the beneficiary might or might not have. This short article just takes into consideration UK estate tax and does not take into account various other taxes or neighborhood regulations. The 2nd family pet ends up being chargeable as it was made within 7 years of her death. As the second family pet is chargeable, it uses up the NRB and there will be an IHT cost on the CLT of 40%.

A crucial variable which distinguishes Discretionary Trusts, nonetheless, is that they run while essential relative are living and can have a say in exactly how they're taken care of. Collaborating with a consultant may feature potential downsides such as settlement of fees (which will reduce returns). There are no assurances that dealing with a consultant will yield favorable returns.

It is very important that you clearly mention your wishes in the depend avoid litigation. Similarly, a trustee can be directed to disperse funds upon a beneficiary's completion of certain landmarks such as college graduation or conclusion of recovery. Among the benefits of a discretionary count on is the security it gives to beneficiaries. This means that the beneficiaries do not have actually a corrected to receive any type of particular property or quantity of cash from the count on. In some cases offering money or possessions outright to a beneficiary-- such as a kid, a grandchild, or a special requirement liked one-- is not suitable for dispersing your wealth in an estate strategy. This is a huge benefit of a Discretionary Count on, as trustees can guarantee the recipients are taken care of, yet you can feel confident that the possessions will certainly not be squandered.

A created contract, i.e. a contract that is typed, published, or handwritten, is not necessarily much more legitimate than a spoken one that has actually just been mentioned orally. There are no lawful distinctions between keyed in and handwritten arrangements when it comes to enforceability. Ought to an event fail to execute before these dates, it leads to an awaiting breach.

Nevertheless, the RNRB can be recovered if the property is appointed out to guide offspring within 2 years of the testator's date of fatality-- section 144 of the Inheritance Act 1984. Do not hesitate to review your options initially with our team of solicitors and will certainly authors in Leicester. Just fill out the type, and we will promptly connect and assist with everything you require to get started. For additional details or recommendations about Discretionary Trusts or Estate Preparation in general, please contact us.

Benefits And Drawbacks Of Setting Up An Optional Trust Fund

A medical sturdy power of attorney paper differs from a living will, which information the medical therapies you desire at the end of your life. A power of attorney for healthcare enables your agent to make clinical choices whenever you are disabled, also if you're anticipated to make a complete recuperation. A depend on can be a useful estate planning device with possible benefits. However, trust funds can be complicated, and they may not be suitable for every person.

Ultimately, mention the day and authorize the will and ask 2 witnesses to authorize as well. Handwritten wills that are composed by the person making the will (called the testator), and have not been seen or notarized, are called holographic wills. Wills remained in existence long prior to computers and word processor, and long before typewriters.

Ultimately, mention the day and authorize the will and ask 2 witnesses to authorize as well. Handwritten wills that are composed by the person making the will (called the testator), and have not been seen or notarized, are called holographic wills. Wills remained in existence long prior to computers and word processor, and long before typewriters.Who Can Create A Will In Canada?

A last will and testimony is a lawful file outlining your want just how your property and events are managed when you pass away and exactly how you desire your family to conduct your funeral service. Having a last will and testimony in place for when the moment comes makes this procedure much easier and cheaper. Your will certainly informs the court exactly what to do with your belongings, so there's much less for the court to kind through. Much less help the court implies your possessions will certainly be distributed quicker, and you'll pay much less in management and Probate Attorneys expenses. When someone passes away, their properties normally approach funeral service expenditures and probate court costs. Then, if the person has any type of outstanding debts, the administrator uses assets from the estate to resolve them.

Additional Estate Preparing Files

You could store the original file and a duplicate in a safe place, such as a fire resistant lockbox, a declaring cupboard, or a safe deposit box at a financial institution. It is necessary to make certain your administrator is aware of the location of your will certainly and has accessibility to it. If you require to make substantial changes, it's ideal technique to create a new Last Will and Asset Distribution Testament.

File Storage Space

Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove - The Washington Post Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove.

Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove - The Washington Post Analysis The Daily 202: Why a freed slave is kneeling in the Lincoln statue in D.C. that some are trying to remove.Although not lawfully binding, Asset Distribution this offers trustees assistance on just how the settlor would such as the trust to be administered. The expression of desires might stipulate, for instance, that the recipients ought to obtain just income and not funding, or that possessions ought to be distributed on a beneficiary's 21st birthday celebration. When an optional depend on is produced, Asset Distribution the transfer of possessions right into the trust undergoes an immediate analysis to Estate tax ( IHT).

What Is An Optional Count On?

A reduced present trust fund is a trust fund which enables clients to distribute assets for IHT purposes, whilst still keeping a right to take normal withdrawals throughout their life time. The value of the present (the premium paid to the bond) is possibly discounted by the value of this maintained right (in basic terms, the right to obtain withdrawals is valued) to reduce the obligation to IHT instantly. Under the loan trust fund system a settlor assigns trustees for a discretionary count on and makes a lending to them on an interest-free basis, repayable as needed. The trustees after that typically spend the money right into a single costs bond (life guarantee or capital redemption version) for the trustees. The finance is repayable to the settlor on demand and can be paid on an ad hoc basis or as regular payments (withdrawals).

Optional beneficiaries have a basic legal right to have actually the Depend on provided in line with the regards to the trust fund record. The primary differences in between the kinds of depend on are the advantageous civil liberties that the beneficiary might or might not have. This short article just takes into consideration UK estate tax and does not take into account various other taxes or neighborhood regulations. The 2nd family pet ends up being chargeable as it was made within 7 years of her death. As the second family pet is chargeable, it uses up the NRB and there will be an IHT cost on the CLT of 40%.

A crucial variable which distinguishes Discretionary Trusts, nonetheless, is that they run while essential relative are living and can have a say in exactly how they're taken care of. Collaborating with a consultant may feature potential downsides such as settlement of fees (which will reduce returns). There are no assurances that dealing with a consultant will yield favorable returns.

It is very important that you clearly mention your wishes in the depend avoid litigation. Similarly, a trustee can be directed to disperse funds upon a beneficiary's completion of certain landmarks such as college graduation or conclusion of recovery. Among the benefits of a discretionary count on is the security it gives to beneficiaries. This means that the beneficiaries do not have actually a corrected to receive any type of particular property or quantity of cash from the count on. In some cases offering money or possessions outright to a beneficiary-- such as a kid, a grandchild, or a special requirement liked one-- is not suitable for dispersing your wealth in an estate strategy. This is a huge benefit of a Discretionary Count on, as trustees can guarantee the recipients are taken care of, yet you can feel confident that the possessions will certainly not be squandered.

- 이전글replica bags cg343 24.10.21

- 다음글fake designer bags zf461 24.10.21

댓글목록

등록된 댓글이 없습니다.