Wedding Arrangements - A How To Assist

페이지 정보

본문

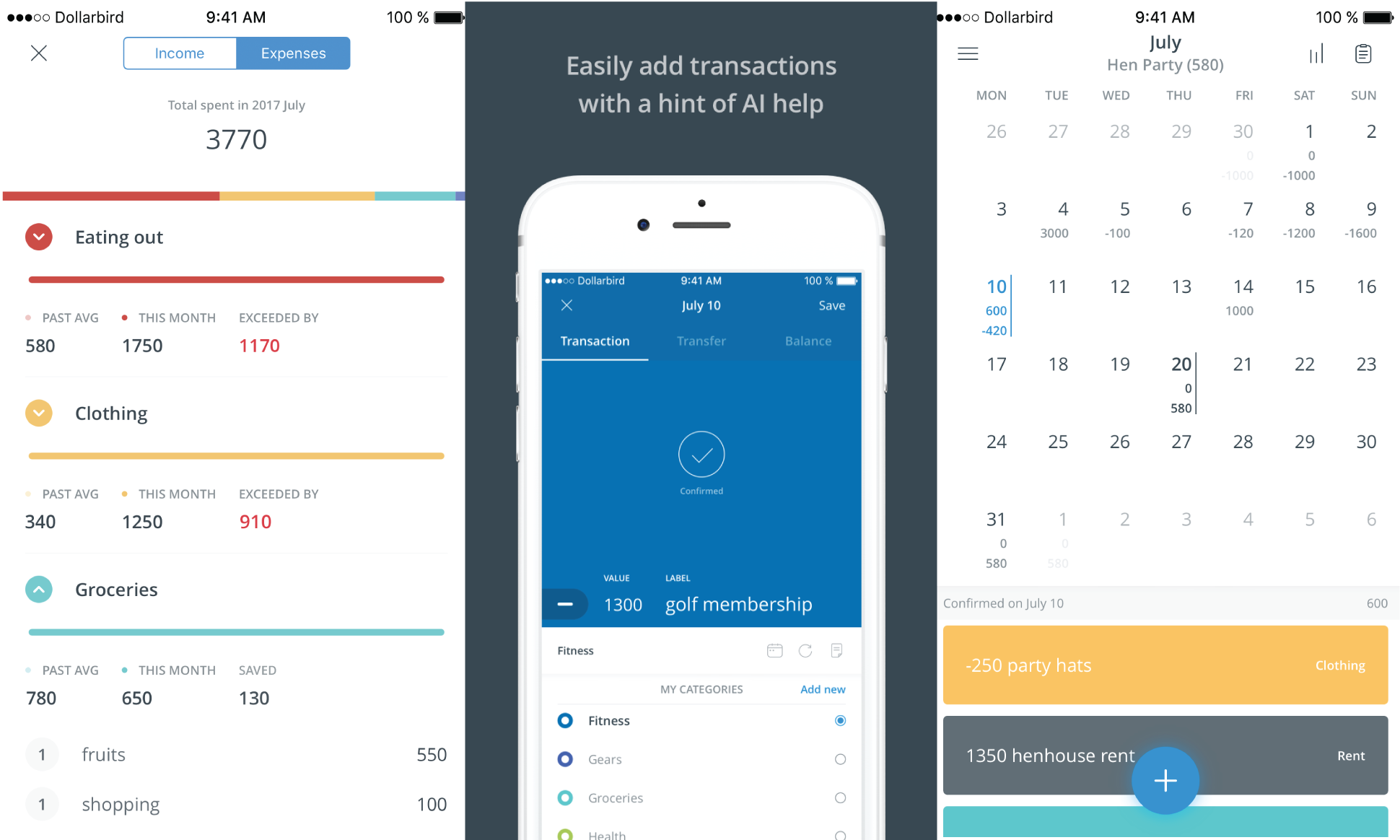

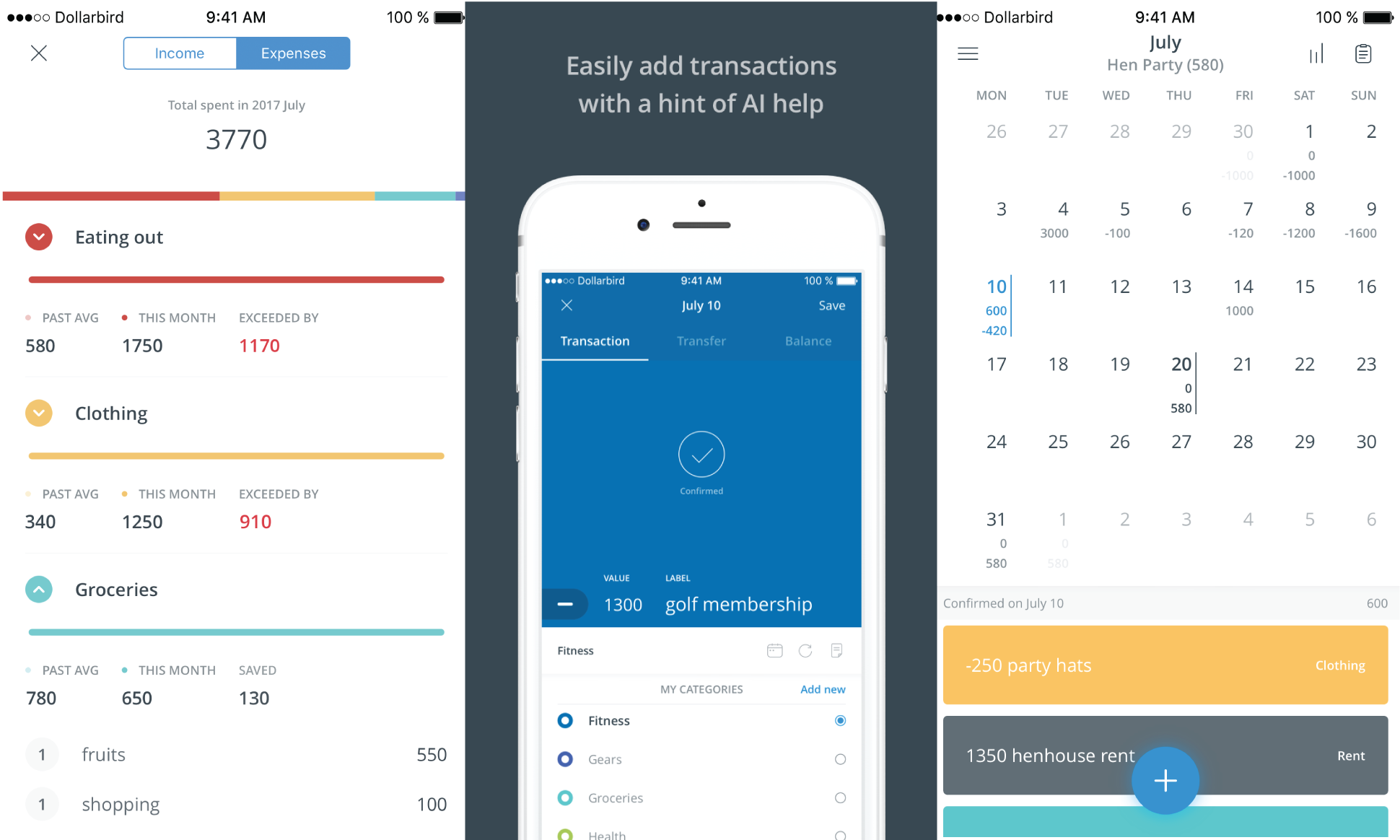

Personal finance budgeting are often a bit of a quagmire. It can be difficult to keep track of spending and making the checkbook balance up every day does not always develop the way we need it to. We lose track of what we have coming in and going out, and soon we look for ourselves in quite economic mess.

11. Square - Approach has become popular my favorite App for money management. Profit Square attempt debit and credit card payments. This particular really is a great resource for any who will want to accept payment when away from a check out or who only occasional take a debit or credit card payment.

If you've made money on a regular basis, create a pay check plan to accomodate your spending patterns for your own income running schedule. If you don't, make sure you plan your budget more sensibly. You can also create a holding free budgeting app narrative. Obviously, when you cash in on more money, you can spend more money.

Navigation - my phone also was included with the navigation app, Navigation, that allows me to go out of my GPS home. I'm able to either type or speak my desired destination. Being able to speak my destination is much safer than trying to type and drive.

It entirely essential a person need to save a lot of money as you and then invest it so that running barefoot can work tirelessly for you. Saving money is vital to working with a nest egg in the for the purchases you want. Saving ingests a plan normally lots of their time. One of things may should do once you get your paycheck is shell out yourself beginning. Take a set amount of your pay check and say it away. When you have money saved, your next step would be to invest it and make it work hard for one. Over the years, you can earn hundreds of thousands of dollars from just $30K to 50K in savings using the vitality of compound interest. A true no magic involved. In order to develop a nest egg in 10, 20 or 30 years save free money management app and invest.

Add all your valuable Income - Add all of the steady money coming in. This means run across total earning that will certainly be which can make introduced. You can include your salary, investment returns and other payments.

CardStar - If you utilize in store rewards cards, then this app's anyone personally. Simply scan the barcode of any store loyalty card and load it onto your phone. May load electronic coupons then just bring them by means of screen in the checkout counter and allowed the cashier scan it. Voila, instant savings! Available on Android, iPhone, Blackberry, Windows and Ovi.

free budgeting app for couples

11. Square - Approach has become popular my favorite App for money management. Profit Square attempt debit and credit card payments. This particular really is a great resource for any who will want to accept payment when away from a check out or who only occasional take a debit or credit card payment.

If you've made money on a regular basis, create a pay check plan to accomodate your spending patterns for your own income running schedule. If you don't, make sure you plan your budget more sensibly. You can also create a holding free budgeting app narrative. Obviously, when you cash in on more money, you can spend more money.

Navigation - my phone also was included with the navigation app, Navigation, that allows me to go out of my GPS home. I'm able to either type or speak my desired destination. Being able to speak my destination is much safer than trying to type and drive.

It entirely essential a person need to save a lot of money as you and then invest it so that running barefoot can work tirelessly for you. Saving money is vital to working with a nest egg in the for the purchases you want. Saving ingests a plan normally lots of their time. One of things may should do once you get your paycheck is shell out yourself beginning. Take a set amount of your pay check and say it away. When you have money saved, your next step would be to invest it and make it work hard for one. Over the years, you can earn hundreds of thousands of dollars from just $30K to 50K in savings using the vitality of compound interest. A true no magic involved. In order to develop a nest egg in 10, 20 or 30 years save free money management app and invest.

Add all your valuable Income - Add all of the steady money coming in. This means run across total earning that will certainly be which can make introduced. You can include your salary, investment returns and other payments.

CardStar - If you utilize in store rewards cards, then this app's anyone personally. Simply scan the barcode of any store loyalty card and load it onto your phone. May load electronic coupons then just bring them by means of screen in the checkout counter and allowed the cashier scan it. Voila, instant savings! Available on Android, iPhone, Blackberry, Windows and Ovi.

free budgeting app for couples

- 이전글비아그라 사망-파워맨남성클리닉부작용심장-【pom555.kr】-시알리스 당일배송 24.09.29

- 다음글A Time-Travelling Journey How People Talked About Mesothelioma Legal Question 20 Years Ago 24.09.29

댓글목록

등록된 댓글이 없습니다.