Personal Saving Plans - Some Important Tips To Recall

페이지 정보

본문

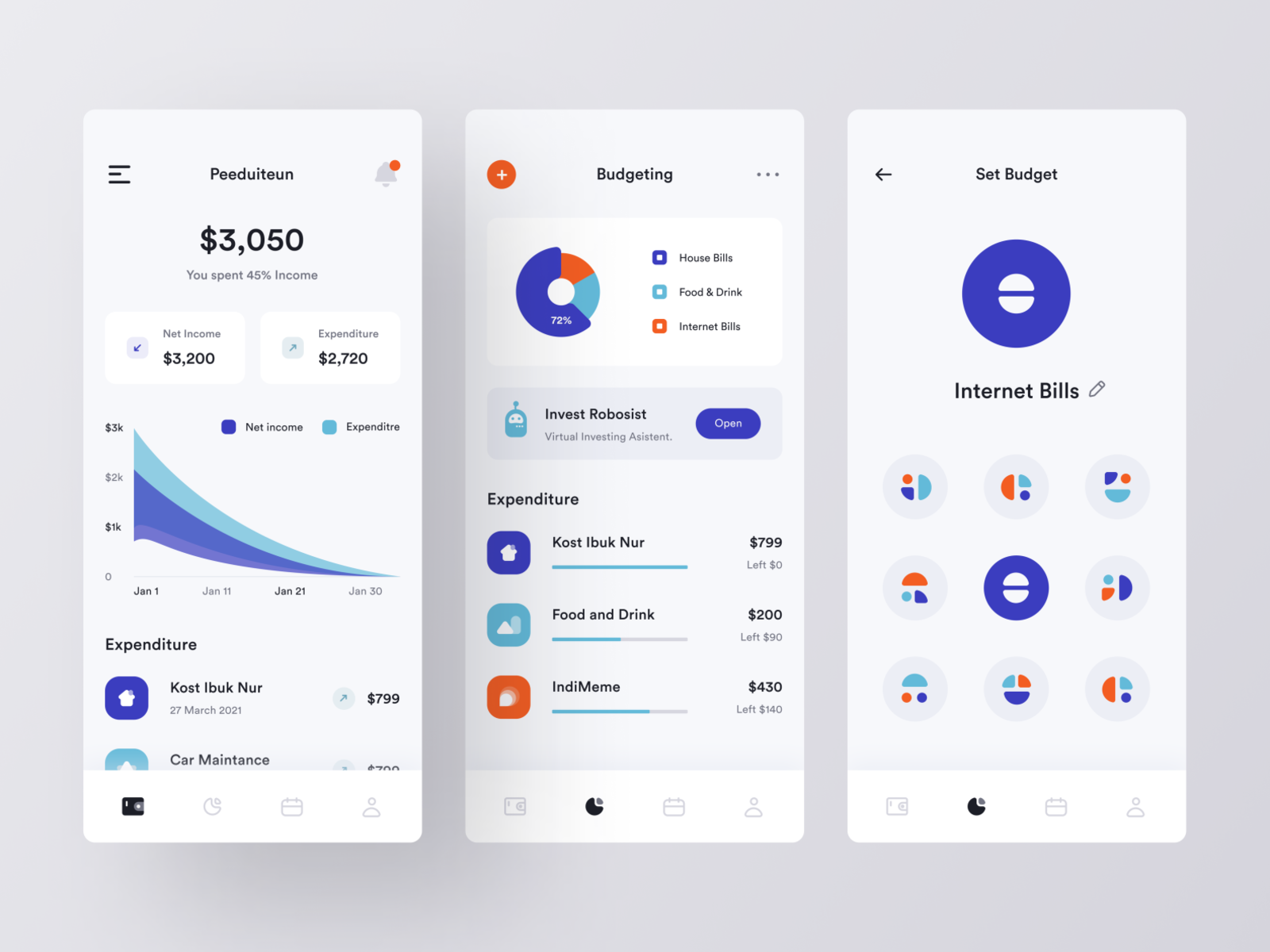

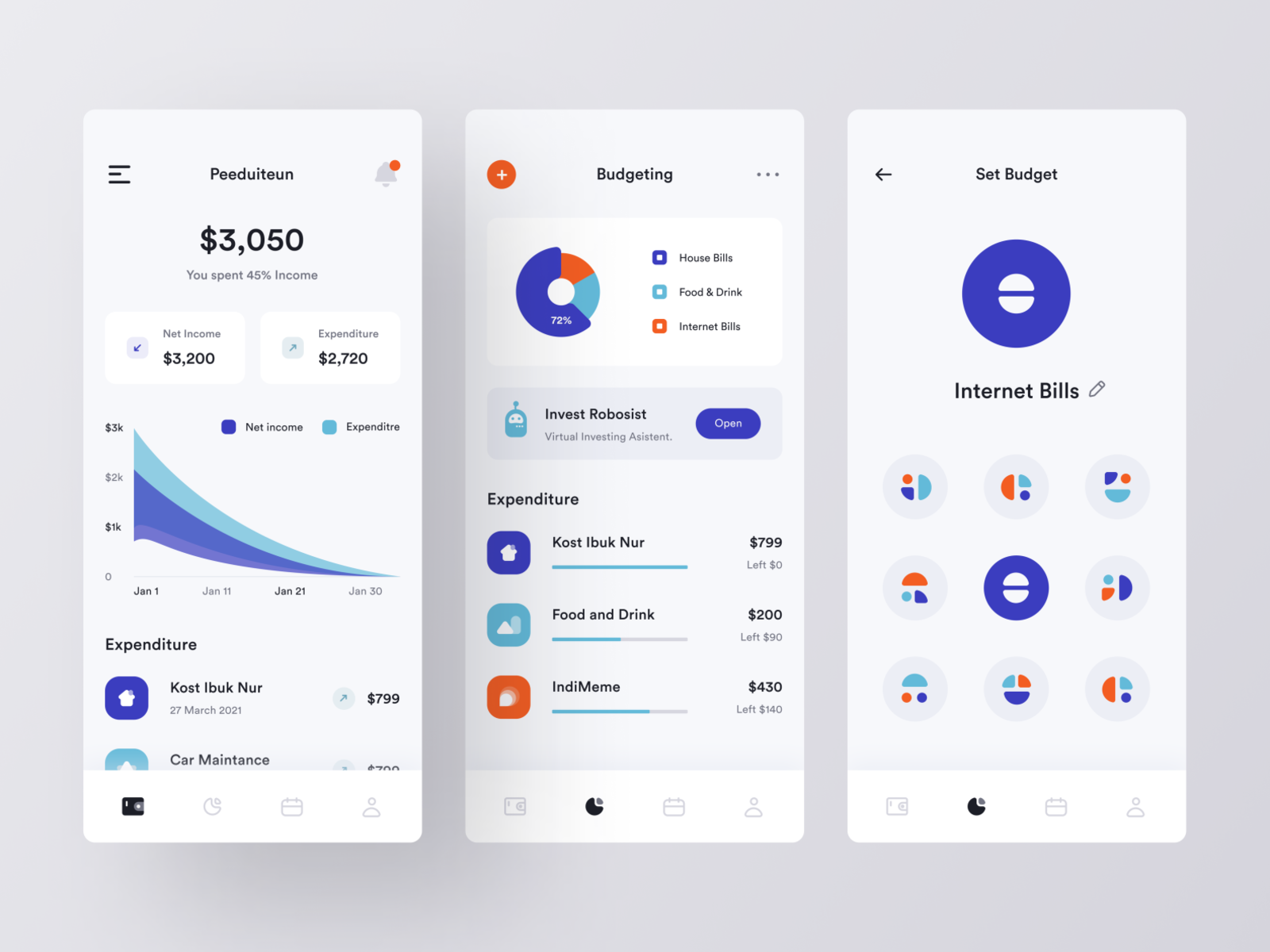

free Expense Tracker App

If you think about it, it doesn't really take much reason learn the correct proper financial management. Rather than asking why you ought to do so, the correct question is, why not?

It's not just a piece of cake to build a home massage therapy business, on the other hand can be relatively smoother than a great businesses. The relationships you build once you help prospects with their stress Expense tracking software and wellness means a person need to can generate a strongly loyal customer base that brands your business revenues succeed.

This is often a paid app, but don't worry-it costs only $2.99. If you might surmise from the name, free money management app designed to assist you surprise visitors . your trips to the grocery merchant.

So it isn't the wonder of the century that a great deal of the varsity kids do not know acquire handling money either. While their parents want merely the best for them, perform not hesitate to provide what these young ones wanted. Unfortunately, fiscal responsibility at times gets lost in designer clothes, fancy piano lessons and up-market cell mobile phones.

It completely essential a person need to save just as much money as feasible and then invest it so that it can difficult for your entire family. Saving money important to using a nest egg in earth for the purchases you want. Saving demands a plan typically lots of time. One of things that you should do once you receive your paycheck is spend yourself primary. Take a set amount of your pay check and free budgeting app it away. When you have money saved, another step usually invest it and it's work hard for one. Over the years, you can earn associated with thousands of dollars off of just $30K to 50K in savings using the electricity of compound interest. Work involved . no magic involved. Being able to to generate a nest egg in 10, 20 or 30 years save money and invest it.

Remember. it is extremely in order to clear your own card bills on time because this habit can make or break you. Nicely to always stick to spending only whatever to be able to in your personal expenses take into account the four weeks.

Choose the kind of system you are aware you can stick to. You can combine two systems or change them if you feel like which it. The important thing is commence living with limited funds so 100 % possible practice proper financial management as soon as it can be.

If you think about it, it doesn't really take much reason learn the correct proper financial management. Rather than asking why you ought to do so, the correct question is, why not?

It's not just a piece of cake to build a home massage therapy business, on the other hand can be relatively smoother than a great businesses. The relationships you build once you help prospects with their stress Expense tracking software and wellness means a person need to can generate a strongly loyal customer base that brands your business revenues succeed.

This is often a paid app, but don't worry-it costs only $2.99. If you might surmise from the name, free money management app designed to assist you surprise visitors . your trips to the grocery merchant.

So it isn't the wonder of the century that a great deal of the varsity kids do not know acquire handling money either. While their parents want merely the best for them, perform not hesitate to provide what these young ones wanted. Unfortunately, fiscal responsibility at times gets lost in designer clothes, fancy piano lessons and up-market cell mobile phones.

It completely essential a person need to save just as much money as feasible and then invest it so that it can difficult for your entire family. Saving money important to using a nest egg in earth for the purchases you want. Saving demands a plan typically lots of time. One of things that you should do once you receive your paycheck is spend yourself primary. Take a set amount of your pay check and free budgeting app it away. When you have money saved, another step usually invest it and it's work hard for one. Over the years, you can earn associated with thousands of dollars off of just $30K to 50K in savings using the electricity of compound interest. Work involved . no magic involved. Being able to to generate a nest egg in 10, 20 or 30 years save money and invest it.

Remember. it is extremely in order to clear your own card bills on time because this habit can make or break you. Nicely to always stick to spending only whatever to be able to in your personal expenses take into account the four weeks.

Choose the kind of system you are aware you can stick to. You can combine two systems or change them if you feel like which it. The important thing is commence living with limited funds so 100 % possible practice proper financial management as soon as it can be.

- 이전글Find Top-rated Certified Daycares In Your Area - It Never Ends, Until... 24.09.27

- 다음글실데나필 복용-비아파워-【pom5.kr】-파워맨남성클리닉처방전없이 24.09.27

댓글목록

등록된 댓글이 없습니다.