Is Gold Mining Stocks Worth [$] To You?

페이지 정보

본문

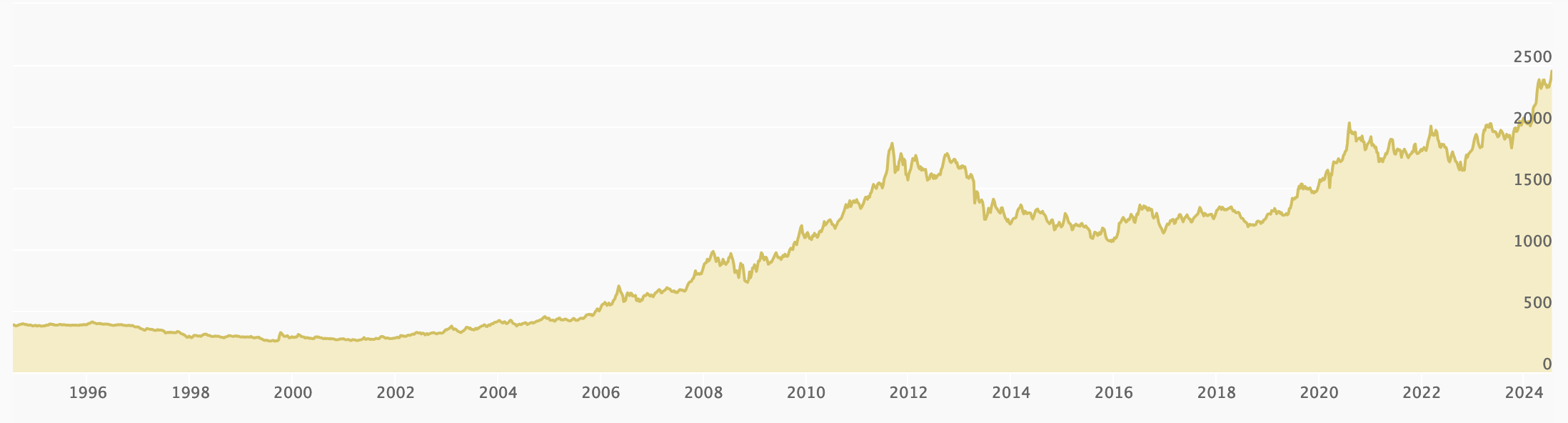

Basically, it’s greatest to look for sellers registered with the Monetary Authority of Singapore. 2. How do I decide which are the perfect gold mutual funds to invest in? Your experience and expertise are very important in navigating the complexities of the gold market and identifying the best funding opportunities for the fund. This analysis is instrumental in serving to you make well-knowledgeable selections about whether or not a particular gold mutual fund aligns with your funding objectives and risk tolerance. Political instability or conflicts between nations have a tendency to extend investor uncertainty and risk aversion. Gold and silver have lengthy been considered a safe haven asset, offering safety towards inflation and economic uncertainty. Historical data exhibits that global events, like monetary crises or geopolitical tensions, have considerably affected silver's worth. However, the worth of ETF and gold stocks are additionally influenced by numerous elements like demand and supply of shares is considered one of them or the change in the basics of the businesses concerned in promoting such gold ETF or into the gold business. More skilled traders who don’t need to risk lots of capital might consider choices on gold futures or options on a gold ETF. And proudly owning an ETF that holds physical bullion also lets you get the total worth of your holding on a public exchange slightly than trade it to a seller at a low cost.

The logistical difficulties of investing in bodily gold bars and gold coins have necessitated new and revolutionary strategies to get exposure to the gold market. Additionally, limited edition or particular edition coins could also be more beneficial on account of their rarity. This high quality of gold can serve as a safeguard towards inflation and foreign money fluctuations, offering stability to your portfolio when other investments may be going through volatility. Diversification is a crucial strategy for managing dangers linked to gold investments. Regularly review your gold investments to ensure they align along with your monetary strategy. Why We Picked It: SGGDX combines a mix of physical gold investments and mining equities, offering a balanced method to gold investing. Why We Picked It: FSAGX gives diversified exposure to the gold sector with a comparatively low expense ratio of 0.70%, making it a cheap choice for traders searching for to capitalize on gold market movements. These funds offer a cost-effective and liquid means to trace the price movements of gold.

The logistical difficulties of investing in bodily gold bars and gold coins have necessitated new and revolutionary strategies to get exposure to the gold market. Additionally, limited edition or particular edition coins could also be more beneficial on account of their rarity. This high quality of gold can serve as a safeguard towards inflation and foreign money fluctuations, offering stability to your portfolio when other investments may be going through volatility. Diversification is a crucial strategy for managing dangers linked to gold investments. Regularly review your gold investments to ensure they align along with your monetary strategy. Why We Picked It: SGGDX combines a mix of physical gold investments and mining equities, offering a balanced method to gold investing. Why We Picked It: FSAGX gives diversified exposure to the gold sector with a comparatively low expense ratio of 0.70%, making it a cheap choice for traders searching for to capitalize on gold market movements. These funds offer a cost-effective and liquid means to trace the price movements of gold.

Listed here are 10 high-performing gold mutual funds to think about. Here are some tips about what to bear in mind when purchasing a gram of 14K gold. He believes gold 'ought to do nicely' in 'an environment where central banks worldwide are printing cash on a large scale' and inflation charges will rise. Interest rates set by central banks can have a substantial impact on gold costs. For these in search of stability and diversification, gold price mutual funds could be a worthwhile addition to an funding portfolio. What Are Gold Mutual Funds? The analyst has observed that millennials are increasingly turning into an vital market partaker in financial markets, with the largest-ever generational switch of wealth of more than $60 trillion projected to occur from baby boomers to millennials. In line with Jason McFarlan, a senior analyst at 24option, the introduction of high frequency trading applied sciences in the inventory market is slowly rewriting the ideas of investing from the practices of the past to quant-pushed methodologies. View requirements for in-person buying and selling. Menger and Böhm apparently insisted on the naïve view that truth will at all times win out, unaided, not realizing that this is hardly the way in which reality ever wins out in the educational or another enviornment.

The answer to this question begins along with your view on the value and purpose of owning precious metals. Which means silver manufacturing is dependent on mining actions centered on these major metals. Managed by Franklin Templeton, this fund invests in firms that produce gold and other treasured metals. First Eagle's fund invests in gold and gold-related securities. When the price of gold increases, it usually results in greater profits for mining firms, which in flip boosts the returns of the fund. Similarly, during periods of inflation or foreign money devaluation, investors flip to gold as a hedge against potential losses. From an asset allocation perspective, gold price ETFs can operate as a hedge towards market volatility and inflation. Physical gold can serve as a safeguard towards inflation and market uncertainties, aiding in diversifying your investment portfolio and mitigating general threat. It is crucial to acknowledge that fluctuations in gold costs can affect the value of those funds. 5. Do I want a large sum of money to invest in gold mutual funds? Gold mutual funds are investment autos that pool cash from multiple buyers to spend money on a diversified portfolio of gold-associated assets, corresponding to bodily gold, gold mining stocks, and gold ETFs.

In case you have almost any concerns concerning exactly where and the way to work with gold price, you can e-mail us at the website.

- 이전글Nine Reasons why You are Still An Amateur At Bangkok 25.01.05

- 다음글(전품목 반값!)【홈: va66.top】비아그라 구매 X-aphrodisiac 구입 25.01.05

댓글목록

등록된 댓글이 없습니다.