Corporate Tax Planning: Strategies, Advantages, And Key Considerations

페이지 정보

본문

This can be achieved by deferring the receipt of funds, structuring transactions over a number of fiscal intervals, or adopting installment sale methods. Deferring income recognition allows companies to optimize their money movement and make investments capital back into the company. Conversely, accelerating deductions permits corporations to frontload expenses, thereby lowering the taxpayer’s taxable earnings. By prepaying certain bills or buying capital belongings that qualify for accelerated depreciation, companies can lower their tax liabilities in the current 12 months. Accelerating deductions can lead to fast tax savings and increased money stream. You additionally might need to acquire sure paperwork to show you made a donation. 5,000 or more require a written appraisal from a certified appraiser. Other restrictions or limitations might apply. One usually neglected tax technique is taking advantage of the long-time period capital positive factors tax rates. Mainly, capital gains are the income made from selling an asset, equivalent to stocks, bonds, real property, or other investments. Once you promote an asset for greater than what you paid for it, you generally have a capital acquire. However, the tax rate on these beneficial properties can fluctuate relying on how long you hold the asset before promoting it.

Practically, salvage value can be thought of as the amount at which a company can sell the old asset at the end of its helpful life. 20k each year under straight-line depreciation. 100k in cash is now out the door, no matter what, but the income statement will state in any other case to abide by accrual accounting requirements. By employing your spouse or children, a enterprise proprietor might be able to deduct their wages as your employee earnings or a enterprise expense, thereby decreasing their taxable revenue. Hiring family members lets you shift revenue out of your greater tax bracket to their lower tax brackets. Using tax credit and incentives is a strategic approach for businesses to reduce their tax burden. This means that they have more money to spend on different bills or make investments. 2. Acquire one of the best Tools: By leasing, companies could afford to acquire the most recent and best tools without having to pay for them upfront. They will outperform the competitors and operate extra successfully because of this. Three. Be Adaptable: Lease agreements may be tailor-made to an organization's precise requirements, including length of lease, payment schedule, and termination clause.

Asset Depreciation Lessors bear the risk of asset depreciation. If the worth of the leased asset decreases, it impacts the lessor, not the lessee. Traders in stocks and bonds may face losses if the value of the funding decreases due to market situations or firm efficiency. In short, asset leasing gives a singular set of benefits, equivalent to predictable cash circulation, tax advantages, and stable returns, whereas conventional investments present possession, liquidity, and potential capital appreciation. Operating Lease permits for right equipment at the best time! It is the right alternative to get the latest equipment and increase your cash move with little upfront funding. Every enterprise requires equipment, however not each business can justify the expense of an outright buy. Operating lease presents an answer to this downside. For those who need to secure vital gear without making a big upfront financial dedication, an operating lease is correct choice for you. Regular & scheduled payments - Managing a collection of small, fastened outgoings across 12-60 months may be simpler for money-circulate delicate companies than having to pay upfront. Want to use gear without ownership - You simply return the tools at end of the contract, eradicating the burden of remarketing from you.

Three. Globalization: Globalization is a major development and alternative for asset leasing. Globalization refers to the method of increasing integration and interdependence of the world's economies, cultures, and societies. Globalization can improve asset leasing by providing entry to new and various markets, prospects, and property, as well as to new and innovative ideas, practices, and solutions. Calculating depreciation expense is a vital aspect of monetary administration for enterprise owners. By understanding and applying various methods comparable to straight-line, declining balance, and models of production, you possibly can accurately allocate the price of your belongings over their helpful lives. This course of ensures compliance with accounting standards and provides a clearer picture of your business’s financial well being. Accurate depreciation calculations contribute to extra exact monetary reporting, which in turn helps knowledgeable choice-making.

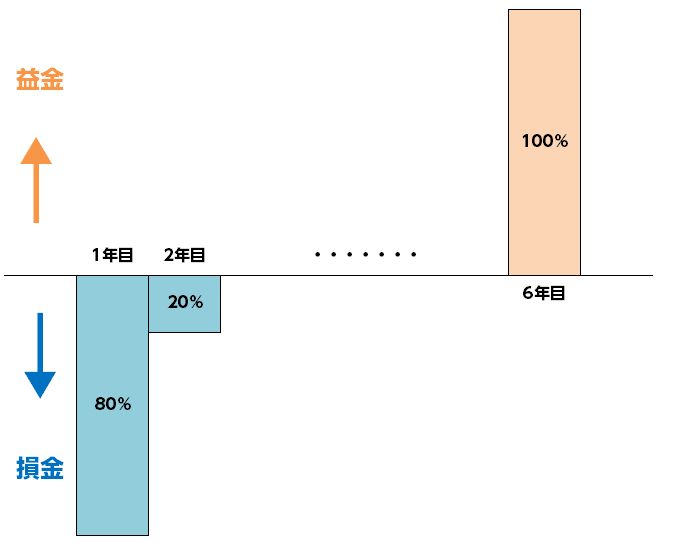

An example of a successful tools leasing company is Caterpillar Monetary Companies Company, which offers financing and leasing options for patrons of Caterpillar Inc., a number one producer of building and mining tools. Caterpillar Monetary Services Company has a global presence and a diversified portfolio of gear, ranging from heavy equipment to power generators. Working Lease: The lease term is usually shorter than the useful life of the asset, making it splendid for assets that are needed briefly or for a specific interval. Finance Lease: The lease time period typically spans nearly all of the asset’s helpful life, and the lessee is dedicated to creating funds for many or all of that interval. Working Lease: Payments are generally decrease than these of a finance lease because the lessee just isn't paying for the full worth of the asset. Payments are handled as operating expenses and should not capitalized. From this, you deduct the quantity of your reserve for the 12 months. 1. Full and file Type T2017 along along with your tax return for オペレーティングリース 節税スキーム each year you're claiming the reserve. 2. Add to your taxable earnings the prior yr reserve you have claimed, if any. 3. Deduct out of your taxable income the present year’s capital gains reserve you may have calculated.

- 이전글Exploring the Best Video Chat Apps Available 24.12.27

- 다음글Onbling Online Casino Review 24.12.27

댓글목록

등록된 댓글이 없습니다.